Research-based Designs Solutions and Their Impact in the Retail Marketplace

Introduction/Executive Summary

Between March 2020 and March 2021, the BHDP Retail team conducted three, nationwide, 1,000-shopper surveys to gather insights on pre-, mid-, and anticipated post- pandemic shopper needs and behaviors. The focus of the research was to learn more about the behaviors and attitudes of the shoppers of specialty retailers. Additionally, over the same time period, BHDP surveyed industry retail leaders and hosted three roundtables with store planners and designers from specialty retail brands to discuss the research findings and retail brand priorities. Based on the results from the surveys and the roundtables, the BHDP team concluded key design decisions retailers can and should make to help shoppers regain confidence and return to the in-store experience they desire. It is clear from the research that shoppers want to return to the brick-and-mortar store format, but they demand the omni-channel and health and safety measures that they have grown accustomed to during the pandemic.

Trends in the Retail Industry

Resilience

The retail sector is resilient. Historically, a cycle of events affecting the retail marketplace occurs approximately every 10 years, even if these events are not directly related to retail. While many retailers regroup and return stronger than before, some do not survive the event’s impact on the retail sector. When shoppers are anxious or uncertain, they alter their shopping habits. Three significant events occurred over the past two decades that disrupted retail and caused anxiety and uncertainty. In 2001, the traumatic events of 9/11 caused widespread disruption across a multitude of industries—impacting retail severely. Seven years later, the great recession started a downward spiral in retail resulting in the loss of many main street brands. It was not until 2010 that this industry experienced growth again. The third event was the COVID-19 pandemic, which essentially halted the retail sector. Fortunately, when shopping anxiety wanes and confidence returns, history has shown that shoppers resume in-store shopping.

The Importance of Omni-channel

Before the pandemic, few brands had fully figured out omni-channel commerce. Some had established multi-channel platforms, but a large number were still relying on either dual or single channels. When stores closed during the pandemic, these brands lacked other vehicles to serve their shoppers. Many struggled with fulfillment issues, and some went out of business. The brands that were better prepared pre-pandemic did well because they already offered shoppers omni-choice options. BOPAC (buy online, pick up at curb) and BOPIS (buy online, pick up in-store) became the norm during the pandemic and these options are here to stay.

Shoppers will not return to their old habits of only shopping in-store or only shopping online. They will expect omni-choice from now on, including “curbside pickup, walk-up windows, lockers, vending capabilities, and cashless and touchless options. To attract these shoppers to come into brick-and-mortar stores, retailers need to develop strong omni-channel solutions. Doing so with an omni-choice viewpoint enables retailers to serve the needs of their shoppers while preparing for the future.” (Shifting Consumer Shopping Behaviors And Its Ramifications For Retailers. White paper available from BHDP.)

COVID-19 Safety in Stores

Retailers and shoppers adapted to the many COVID-19 safety measures implemented by retailers, including mask wearing, enhanced store cleaning, plexiglass screens at checkout areas, and decals on floors to encourage physical distancing. While some of these measures were meant to be temporary, retailers are considering more permanent COVID-19 protection solutions, too. This is a vital design issue since incorporating these long-term COVID-19 enhanced safety measures in the retail space is important to shoppers, even as restrictions are being lifted globally.

As retailers plan for the future, listening to shoppers and understanding what they are saying about their current and future shopping behavior is crucial to avoid any disconnects. For the shoppers who want to return to the store, how do we make that happen?

Research Scope

The purpose of BHDP’s research in March 2021 was to gather information from specialty retail shoppers as we were seeing the trajectory of the pandemic change. This was a time when COVID-19 cases were declining, vaccinations were increasing in the general population, and health and safety mandated shopping restrictions were eased or lifted in many states. BHDP prepared the research survey and engaged an independent, online research firm to gather input from 1,000 specialty retail shoppers from across the country. To be eligible for this survey, these shoppers were above the age of 13 and were required to have purchased items within the past year (2020-2021) from a minimum of three different retailers from the pre-defined list of 26 retail brands. If respondents stated they always shopped online, they were disqualified from the survey. The retailers included in this research were Abercrombie & Fitch/Hollister, Altar’d States, American Eagle/Aerie, Anthropologie/Urban Outfitters, Apple Store, Casper, Bath and Body Works, Bonobos, Chico’s, Claire’s/Icing, Columbia Sportswear, The Container Store, Disney, Eddie Bauer, Estee Lauder Brands (including MAC, Origins, Clinique), Gap/Old Navy/Athleta, L.L. Bean, Levi’s, Lululemon, Nike, Restoration Hardware, Sephora, Tiffany & Co., Under Armour, and Warby Parker. The survey launched on March 5, 2021, and closed on March 8, 2021. Demographic data including gender, culture/ethnicity, income, and age also was collected.

Research Objectives

The goals of the research were to:

- Identify specialty retail shopper behaviors relative to purchasing from traditional brick and mortar retail stores in a post-pandemic environment.

- Uncover the influences on specialty retail shopper behavior. Survey respondents were specialty retail shoppers who occasionally shopped online but preferred to do most of the shopping by visiting a brick-and-mortar branded retail store.

- Understand which retail environments specialty retail shoppers currently prefer to shop and where they predict they will shop in the future.

- Identify opportunities to enhance the in-store shopping experience to create stronger brand loyalty and greater frequency of in-store visits.

- Discover which COVID-19 safety precautions make specialty retail shoppers feel safer or more at ease when shopping in-store.

Research Findings

In this study, 63% of shoppers were female and almost 85% of shoppers were between the ages of 25-64 years old. Prior to the pandemic, 43.3% preferred to shop mostly in-store, 28.7% preferred to shop online with products shipped to home, and 13.1% had no preference. The younger and older aged shoppers were the segments that most preferred in-store shopping: 60% of 13-17-year-old shoppers and approximately 50% of those 45-years-old and older stated their preference for shopping in-store prior to the pandemic. Shoppers’ favorite brands to shop in-store included Bath and Body Works, chosen by 23.1% of shoppers, Nike (12.9%) and Gap/Old Navy/Athleta (12.5%). There was a significant increase in overall shopping activity—up by 48% between the June 2020 and March 2021 shopper surveys.

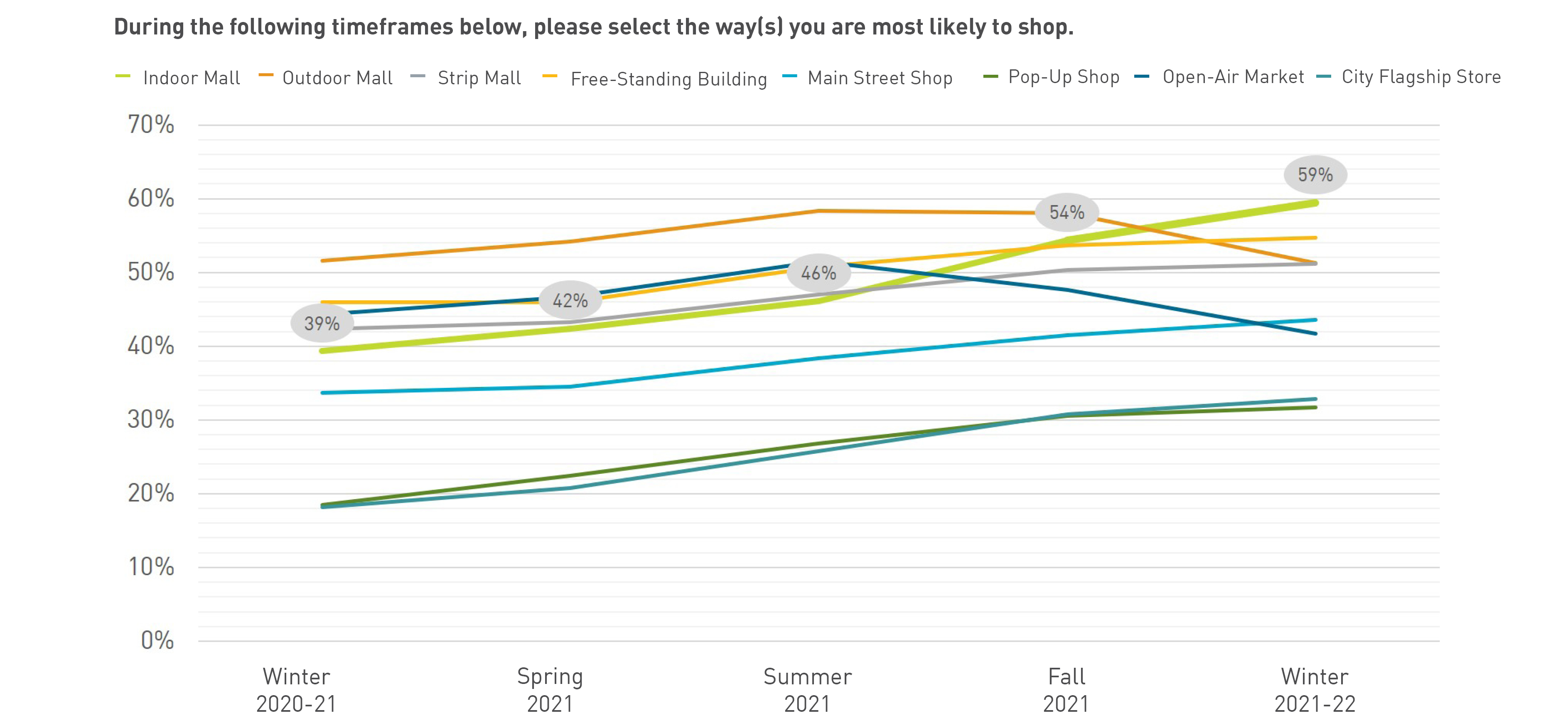

Shoppers were asked to indicate how they currently shop as well as forecast their anticipated behaviors over the coming year (Spring, Summer, Fall, and Winter). The desire to shop at indoor malls increased from 39% in the Winter 2020/2021 period to 59% in the Winter 2021/2022 period. In fact, 69% of 18-24-year-old shoppers surveyed said they likely will be shopping in indoor malls by Winter of 2021/2022. A similar trend was indicated for anticipated growth in main street shops and city flagship stores.

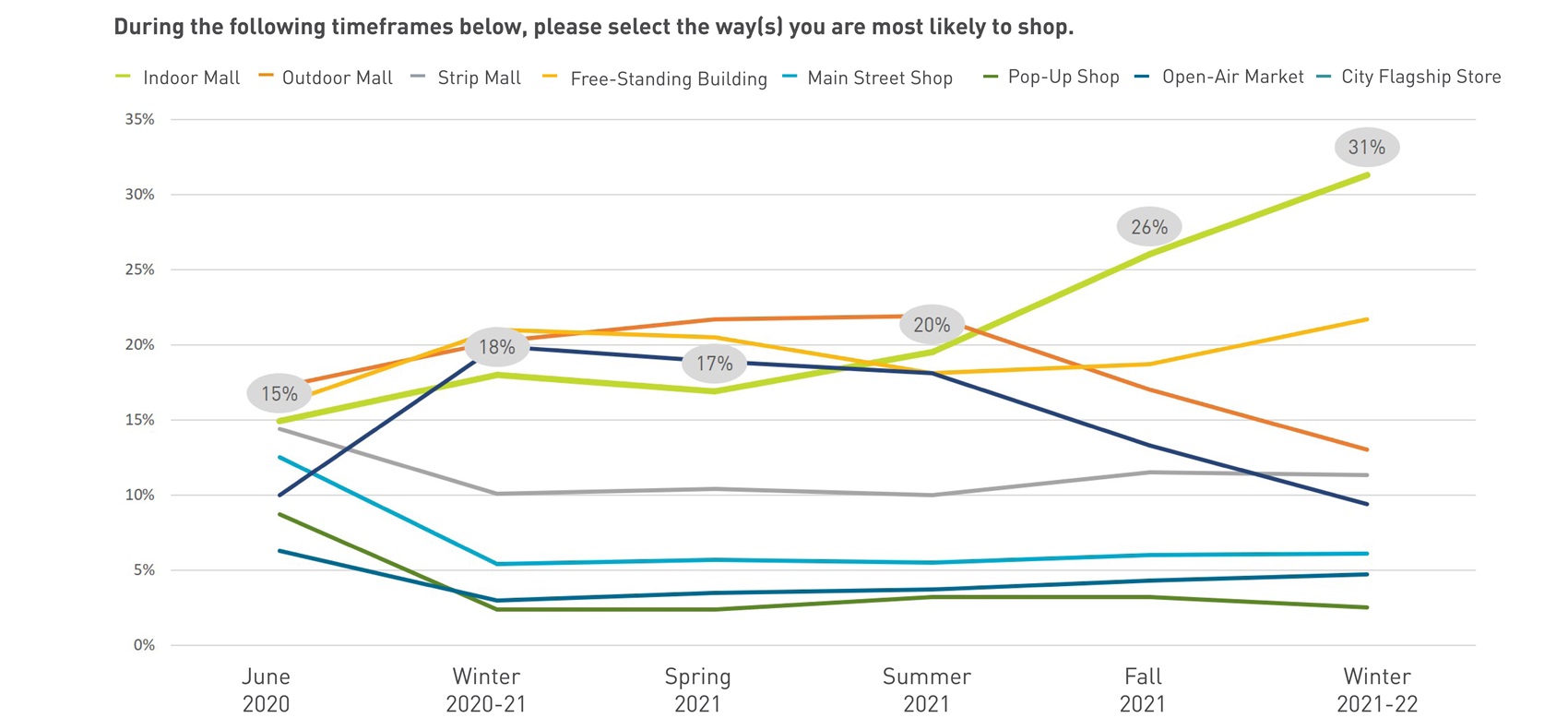

Interestingly, in the June 2020 survey, when asked which formats they are likely to be more comfortable shopping in, shoppers stated they favored outdoor malls and free-standing retail buildings instead of indoor malls. The March 2021 data shows a pivot as the preference for indoor mall shopping increased from 20% in Summer to 31% in Winter, with 43% of 18-24-year-olds again stating they will be more comfortable shopping in indoor malls by Winter 2021/2022. The youngest age group (13-17-year-old) showed a strong preference for shopping in indoor malls. None of these shoppers said they would be most comfortable shopping in outdoor malls in Fall 2021 and Winter 2021/2022 and only 5% said they would be comfortable shopping there in the Spring. The majority of this age group (90%) said they are most likely to shop at indoor malls in Winter 2021/2022. This pivot for shopping in indoor malls also was apparent in both females and males.

The top reason for shopping in-store was the ability to examine product. One shopper said, “I need to know exactly how it looks in color, size, and style,” while another commented, “Sometimes pictures on the internet don’t tell the whole story on a product.” Additional higher-ranked reasons included convenient store location, special sales and promotions, and affordable pricing. “It’s nice to have a store close to where you live,” said a shopper. Many shoppers (41.9%) prefer to shop in physical stores because it is fun. Several shoppers commented that shopping is an enjoyable shared experience with friends or family members. One shopper said, “I love catching up with my girlfriends while shopping. We usually make an afternoon of it and have lunch together, too. Also, it’s great to get a second opinion on the items we are considering.” The in-store experience, design, or atmosphere of the store would influence 26.9% of shoppers on whether they return to the location. One shopper said, “Having a good experience makes it more memorable and enjoyable,” while another stated, “I love the idea of getting back to shopping and exploring things in person again.”

Shoppers are more willing to travel to shop in-store. In the March 2020 survey, 9.6% of shoppers said they were willing to travel up to 45 minutes to shop in-store. This increased to 17.8% in the June 2020 survey and again to 23.8% in the March 2021 survey. The majority of shoppers in this survey (75%) would travel 16-45 minutes to shop in-store rather than shop online.

I love the idea of getting back to shopping and exploring things in persona again.

Survey Respondent

Shoppers were asked to rank the factors which positively influenced them to return to a store. Affordable pricing was the top ranked factor, followed by the ability to inspect product. Convenient store location also was important and was selected by 50% of 35-44 and 45-54-year-old age groups and just over 60% of the 55-64 and 65+ age groups. The highest ranked factors influencing shoppers to not return to a store included low inventory/out of stock, which was selected by 55.8% of shoppers, too expensive (42.8%), dirty/disorganized (42.2%) and poor/disappointing service (41.1%).

While 61.5% said they will not have any concerns shopping in-store after the pandemic, COVID-19 safety protocols are still important to shoppers. One shopper who had a positive experience with in-store shopping explained, “They followed all of the safety measures for protecting their customers against COVID-19.” Conversely, many shoppers said “COVID” was a reason not to return to a retail store. To feel safer or more at ease while shopping in a store, 57% want hand sanitizer at the entry, 54.9% want employees required to wear masks, 54.6% want shoppers required to wear masks and 51.1% want cart wipes available at the entry.

Research Scope and Findings – Retail Virtual Roundtable

In March 2021, BHDP hosted a virtual roundtable with 12 retail industry leaders representing a broad spectrum of sub-sectors from the U.S., Canada, and the U.K. The goal of the session was to share perspectives on anticipated shopper behaviors and their impact on store planning and design as well as retail business models. Participants included representatives from the apparel, grocery, home, sportswear, lingerie, telecommunications, and QSR (quick service restaurants) sectors.

Before the roundtable, participating industry leaders completed an online survey regarding retail strategies. These retailer questionnaire responses indicated an optimistic view of the year ahead. Forty-four percent of retailers said they are managing through the uncertainty and 33% said that uncertainty is low, leadership is optimistic, and they see opportunities for the growth of their brands in the next 12 months.

The common sentiment from the roundtable represents the uncertainty of the future. Finding the answers to these questions are on their minds as they emerge from COVID-19 restrictions.

- Will shoppers follow the forecasted patterns displayed in this survey?

- Are these anticipated behaviors driven by current shopping limitations and restrictions?

- Is there a pandemic skew factor at play here?

- Will these habits formed last year linger or carry on for a significant time?

- How do retailers reach shoppers who may never return to in-store shopping?

The most desirable options for retailers growing their physical brand were outdoor malls, urban settings, and suburban strip centers. Indoor malls and pop-up/mobile retailers were the least desirable options. The future of indoor malls was a widely discussed and hotly contested topic well before the onset of the COVID-19 pandemic, with many publications and industry contributors predicting the demise of the indoor mall format. As a result, many retail brands have been exploring “off-mall” strategies in an effort to respond to the behaviors and preferences of tomorrow’s shopper.

Retailers were asked about their current strategic priorities. The top responses included “implement stricter hygienic standards in store operation procedures,” “incorporate innovative tech solutions as a component of in-store/online shopping experience,” and “adjust capital allocation strategy to fund more permanent solutions to BOPIS/BOPAC.” Retailers also were asked which components may be a part of their future strategies. All of the retailers surveyed stated that “enhanced in-store technology and messaging” would be a component, 89% plan to expand digital sales and online marketing, and 78% will use “alternate materials to show heightened compliance with sanitization requirements. BOPIS and BOPIC options will be offered by 78% and 67% of these retailers, respectively. Finally, retailers believe shopper anxiety will decrease and confidence will increase as time passes.

Analysis of Findings and Results

Anxiety is decreasing and confidence is growing among shoppers. Shoppers were asked in the June 2020 survey how they were currently shopping at that time and how they will likely shop post-COVID-19. The responses in this survey indicate a substantial shift from mostly online shopping back to mostly in-store shopping. The number of shoppers returning to in-store shopping post-COVID-19 increased by 61%, while the number or shoppers preferring to shop online with ship to home decreased 59%. Additionally, the “no preference” category also increased substantially over the two timeframes. Even with the current increase in shopper confidence, it is important for retailers to continue monitoring shopper anxiety and make adjustments as necessary to help shoppers feel comfortable with returning to in-store shopping.

There is a distinct change in the types of stores shoppers are frequenting today compared to during the middle of the pandemic and even at the start of the pandemic. In the 2020 surveys, Bath and Body Works was the top choice for in-store shopping, most likely due to the availability of sanitizing and hygiene products. In the March 2021 survey, leisure and outdoor brands took the lead as consumers shopped more for casual and athleisure wear. In fact, Nike was the number one choice for in-store shopping in this survey, with Bath and Body Works a close second. Shoppers also are buying more beauty items as they return to their normal routines and more luxury items to reward themselves. This data indicates lessening shopper anxiety and more focus on purchasing products aligning with shoppers’ evolving lifestyles.

One of the common data threads identified in the three surveys is the recognition that shoppers visit physical stores to examine products to confirm style, size, fit, color, and texture. Fifty-two percent of shoppers indicated this is the primary influencer to shop in-store. Affordable pricing, sales, and promotions are no longer the driving factors for returning to in-store shopping. Instead, shoppers said they want the ability to inspect products and leave the store with the product in hand, something they have not been able to do in a while.

When comparing the June 2020 and March 2021 surveys, additional in-store influences were highlighted by shoppers. These included the ability to return products, the importance of supporting local retailers, enjoying the experience with a friend or family member, exposure to unique selection/brands, personalized service, and the ability to leverage technology in-store to facilitate the purchase process. Convenient store hours and friendly/helpful service also increased slightly between the June 2020 and March 2021 surveys. Even greater increases were seen between the two survey periods with store design/atmosphere and brand loyalty driving shoppers to return to in-store shopping. One shopper liked getting credit for being a regular customer and another stated, “Brand is the most important reason I choose to shop at a particular establishment.”

In-store inventory issues are a prime reason for why shoppers may not return to a store. The selection of this reason was up 22% from the June 2020 survey. On a similar note, shoppers indicated their disappointment in not being able to leave the store with purchases in hand, limited store hours, parking issues, and difficulty finding stores.

Brand is the most important reason I choose to shop at a particular establishment.

Survey Respondent

Shoppers were asked to predict their future shopping behaviors. The data showed a positive trend line for shoppers’ desires to return to indoor malls, especially in the 13-17 and 18-24-year-old age groups. Yet, in the retailer roundtable, retailers indicated their best opportunities were in outdoor mall and urban locations, with indoor mall strategies relegated to the bottom. The consensus of these participants was the shopper survey results could be attributed to a reaction to the pandemic as shoppers have been deprived of a “normal” retail situation.

Even vaccinated shoppers still want safety measures in place. More shoppers in this survey as compared to the June 2020 survey indicated they wanted both employees and shoppers to wear masks and to limit the number of shoppers in the store. While retailers indicated they plan on continuing some of the COVID-19 safety measures in the future, the majority (67%) stated reducing maximum store capacity was not one of these safety components.

Recommendations

During the COVID-19 pandemic, shoppers were deprived of the excitement, fun, and joy of in-store shopping for more than a year. As they come back to shopping in pre-pandemic levels, retailers will need to deliver an in-store service experience that is bigger and better than before COVID-19 to retain these shoppers in-store.

Levels of anxiety rose to concerning levels after the onset of the pandemic. Strategies for relieving shoppers’ anxiety about COVID-19 should be a top priority for retailers. Mask wearing by both shoppers and store associates is a high priority along with the continued visibility of safety procedures in store for the shoppers in this survey. It also appears shoppers are uncomfortable with crowded shopping environments and support limiting number of shoppers in store at any one time. One shopper specified, “It was a high-risk environment with too many people cutting corners on COVID,” as a reason to not return to a retail location. Additionally, shoppers want to see honest communications about heightened procedures in-store and descriptions of these safety procedures not just in-store but also readily accessible online. Retailers can visually communicate to shoppers how they are making their stores safe through experiential graphic design. One example is a description of enhanced air quality within the store environment. While the obvious messaging about store cleanliness and sanitization standards will likely stay in place at the store entry for some time, these messages must describe “actual” procedures and not “intended” procedures. Transparency is crucial so shoppers know retailers are taking safety seriously. “I love shopping here because they observe safety precautions,” explained a shopper. Retailers can demonstrate their commitment to COVID-19 safety by being clearly obvious to in-store shoppers that heightened procedures are in effect and being practiced in front of their eyes.

Omni-choice will continue to be important to shoppers. How shoppers fulfill their needs is changing. During the pandemic, most were shopping online and not in-store, a trend that is reversing. Shoppers now expect to be able to acquire their preferred products and services through a multitude of channels. Plus, omni-choice creates shopper loyalty. Shoppers recognized their preferred retailers were doing whatever they could to satisfy shoppers’ needs during the pandemic, increasing the likelihood shoppers will stay with these brands in the future. Brands risk losing shoppers and loyalty if they are not meeting shoppers’ needs. This means retailers that want to deliver meaningful shopper experiences across all physical channels will continue offering omni-channel options including curbside, drive-thru, pick-up at store, and pick-up lockers.

In the survey, retailers indicated that funding of more permanent solutions to BOPAC/BOPIS is a low priority. This is unfortunate since shoppers still want these options even when returning to shopping in-store. Some retailers only did the bare minimum with offering BOPAC/BOPIS. For example, they created a temporary solution consisting of a simple display outside of their stores, such as a plastic bucket filled with concrete supporting a temporary post that says “Pick Up Here.” The problem with this display is the brand expression and experience are missing. This may be the shopper’s only interaction with the brand until the shopper is comfortable returning to in-store. The restaurant and banking sectors established the drive-thru and pick-up experiences decades ago, but mainstream retail has struggled over the last several months to provide a similar pick-up at store experience. Instead, retailers need to significantly improve the “at store” experience by extending the brand expression to embrace those critically important “at store” moments. This means bringing the in-store experience out to the shopper at curbside, figuring out how to express the brand in the parking lot, and creating meaningful shopper-retailer interactions comparable to in-store interactions. This change should be viewed as an opportunity to further engage shoppers instead of a temporary fix. Retailers can evaluate their capital allocation budgets and creatively reallocate funds to invest in the curbside and at-store pickup areas to deliver a true omni-choice experience for shoppers through a more permanent expression of the brand outside of the store.

One big shopper trend is the preference for shopping at indoor malls. Although indoor malls continue attracting all ages, in this survey, the younger age groups expressed the highest desire to get back to the indoor mall environment. Indoor malls are a social magnet for teens, providing a safe and fun environment to connect with their friends in person. The COVID-19 closures and distancing rules greatly impacted this group. Additionally, while colder weather may explain some of the preference for indoor malls in the winter by all age groups, it should be noted that the indoor mall preference in Winter 2021/2022 was the number one choice in all geographic regions of the U.S. Investing in indoor malls is a tension for retailers as the participants in the retailer roundtable were not convinced in the long-term viability of indoor malls.

Nothing compares to a smile and the willingness that a sales floor person brings to the shopping experience.

Survey Respondent

The economics of store development always is a key factor that determines retailer’s expansion plans. “Upcycling” was discussed as a means for retailers to limit capital investment to bring new retail spaces to market. One example is to take vacated retail spaces and only do a limited amount of work on the existing décor to successfully bring the brand to life. Another format explored by retailers is mobile retail. This method allows for brands to test potential markets to introduce themselves to new regions with the ability to relocate rapidly to other locales. Both formats limit capital investment by avoiding the expense of long-term leases and upfit costs. When rethinking and re-strategizing stores and store layout, consider designs with more open space and less clutter, possibly with less SKUs out on the sales floor, as shoppers want to be in less crowded stores.

Shopper engagement with retail associates is key. It is no longer all about wowing shoppers with all the bells and whistles as they enter the store. Shoppers, especially those from the younger generation, want authenticity, transparency, honesty, and connection with their favorite brands. “Nothing compares to a smile and the willingness that a sales floor person brings to the shopping experience,” said one shopper. Loss of in-store revenue may be offset by sales through other channels, but BHDP’s March 2020 Clicks to Bricks shopper research study demonstrated in-store shopping not only builds brand loyalty, drives brand awareness, and increases basket size, but it also increases online sales. (What Do Shoppers Really Want? Lessons Learned from Clicks to Bricks. White paper available from BHDP.) During the pandemic, shoppers remained brand loyal and were forced to use alternate channels to fulfill their needs. It is likely that their personal service needs were not met throughout the pandemic as the one-on-one interaction with store associates who know them and could provide personalized services was absent in these alternate channels. In-store associates can make or break the personal connection with shoppers. Now that stores have reopened, retail associates need the training and tools to enhance and increase personal shopper engagement. Comments about retail associates on the survey included “Friendly staff at all locations I have visited,” “efficient customer service,” and “I like going to a store where the staff is friendly and knowledgeable of their products.”

There are additional issues influenced by COVID-19 that may affect retailers’ decisions about their store locations. More than half of the U.S. population worked from home over the last year. While that number has decreased since March 2020, it is likely a sizable portion will remain working from home for the foreseeable future. The work-from-home scenario has created a suburban satellite office environment. It also keeps workers in close proximity to their local suburban malls. This certainly may be influencing future shopping habits. On a similar note, geography may play a part in how shoppers forecast their behavior over the next 12 months. At the time this survey was conducted some states significantly lessened restrictions essentially allowing shoppers to behave as they did pre-pandemic. Other areas of the country continued with their more rigid restrictions. It is possible that this geographic phenomenon skewed the research data.

A main area of frustration for shoppers caused by the pandemic and still affecting retail is the issue of fulfillment. Online options saved many retail categories and brands during the pandemic, but omni-channel engines still lagged behind shopper needs due to supply chain challenges. Fulfillment issues were widespread over the past year due to the pandemic. It is a point of contention for shoppers as they experienced delays and product scarcity. Retailers know shoppers want to get back in-store, but they cannot afford to disappoint their shoppers once they start the return to brick and mortar stores. Product shortages are a top reason why shoppers will decide to return or not to return to a particular store. This is supported by shopper responses to the survey question, “What has previously influenced you to not return to a store?” Low inventory, limited product choices, and inability to leave the store with a purchase all showed significant increases in the June 2020 survey. Shoppers also indicated their desire for more curbside pickup options and their high preference for open air storefronts.

How do retailers ensure shoppers will have the ability to leave the store with their purchases in hand? The potential price a retailer pays for not solving fulfillment issues and for not being able to avoid product shortages is the loss of that in-store shopper to another more available channel. One solution is transparency—provide shoppers with better product availability updates and tracking tools that let them know how the retailer is working through this monumental fulfillment challenge. Give shoppers the confidence that their brands will soon be back to providing the products, services, and choices they want.

There are multiple factors impacting shoppers’ behaviors by brand, category, and geographic region. It is essential for retailers to know their shoppers in terms of past, current, and anticipated behaviors. Understanding future habits will provide a clearer picture of what is ahead and inform store development plans. This is not just typical sales data. It is about capturing “in-store behavioral data.” By surveying shoppers quarterly and comparing the data to their sales data, retailers can build a behavioral change picture. This allows retailers to validate and compare new data over previous data, identify patterns and trends, and ultimately determine if current data is skewed by the pandemic or if the anticipated shopper shift will be fulfilled.

Looking Ahead to Create a Competitive Advantage

There are many unanswered questions in the retail landscape. How will the next year play out for the industry? Will the newly formed habits, such as heavy reliance on online ordering, home delivery, BOPAC, and BOPIS, linger? Or will shoppers revert back to their pre-pandemic shopping behaviors? And, if shoppers return in-store, will they gravitate to indoor malls or off-mall?

Regardless of the questions on retailers’ minds, one solution does not fit all. As the shopper research indicates, there is a place for all retail formats—from urban to suburban. The mall/off-mall strategy will likely be specific to each individual retail brand, driven by their shopper profiles, age groups, demographics, product offerings, and store geography. Exploring off-mall strategies is a good course, but it is important to be wary of concentrating all efforts into one area until the industry sees how shoppers behave over the next several months as shopping returns to a level of normalcy.

It is clear what shoppers are saying is different from what retailers are planning in terms of off-mall strategies. Shoppers want to get back in-store and return to a normal shopping life. For some shoppers, it is more of a destination and an experience. They want shopping to be fun and enjoy it with their families and friends. In fact, 75% of 13-17-year-olds stated they preferred to shop in-store because it is fun. They spent the last 12 months or more without shopping in-store and their desire has multiplied to get back in-store. For many shoppers, this is going back to indoor malls.

Retailers were surveyed in March 2020 and asked if they were prepared for the pandemic. Of course, the answer was no. It is time to expect the unexpected, become more flexible, and anticipate future challenges such as product procurement and satisfying new shopping habits. Shoppers will not tolerate empty shelves again. The rigidity of the retail industry hampered its ability to react quickly. Often the infrastructure and processes are so complex that even small changes take considerable time. Retail models lack flexibility, which competes with adaptability and fluidity. In recent years, the retail category saw sporadic innovation, with a few sub-categories performing better than others. Today’s mindset should be two-steps forward with constant innovation front and center. Retailers can learn from the past, and they should not be afraid to look ahead, anticipating the next step.

Retailers owe it to shoppers to provide the best possible experience as shoppers return in-store. They do not want to risk losing shoppers, business, and market share. For shoppers, it is more than just purchasing product. Malls are attractive to shoppers because they have the retail, food, and entertainment components. Do not disappoint shoppers with the same old in-store experience. Bring innovation into the retail settings to enhance the shopping experience. Shoppers were asked about their favorite brands to shop in-store. Comments included “It feels like a vacation,” “It is a really innovative store,” “My child loves the in-store experience,” “Such a fun, happy store. I’m always excited to enter the store,” and “I love the vibe in this store. It’s very relaxed and the staff seem to have the perfect know how in being helpful but not smothering.” These surveys also demonstrated that shoppers come to stores for the one-on-one advice and relationship with in-store professions. Satisfy shoppers’ needs with personal interactions with retail associates—the component not easily available with online, BOPIS and BOPAC.

In approximately a 12-month period, the retail landscape transitioned from extreme anxiety and uncertainty to confidence on both sides of the aisle. Shoppers are displaying growing optimism and less anxiety about returning to in-store shopping. Retailers want to get shoppers back into their stores and shoppers want to return to in-store shopping. Retailers must act now to regain the confidence of shoppers and prove this resilient industry is ready to deliver new and innovative products, enhanced services, and multiple path-to-purchase channels to our shopper base. The solution is investing in the in-store and at-store experiences, ensuring shoppers’ safety, eliminating product shortages, and providing omni-choice solutions.

Author