The Retail Rumba: One Step Back, Two Steps Forward Part III of III

A lot has happened since our second installment of the Retail Rumba. In just eight weeks, the retail landscape has begun to change in a promising way. For the first time in quite a while, the positives outweigh the negatives.

Improving Conditions

Many of the variables that affect the performance of the retail industry are trending in the right direction. Unemployment rates continue to drop. From 14.8% at the onset of the pandemic in April 2020, it now stands at 6% in March 2021. The Federal Reserve predicts that 2021 unemployment will average out to 4.5% before declining over the course of 2022 and 2023 to 4.2% and 4.0% respectively. The inflation rate remains low, currently at 2.6% with expectations to end the year at 2.26%. Typically standing at +2.5+/-, GDP took a nose-dive to -2.4 in 2020, but is forecasted to rebound energetically to 7.3 for 2021 and then level off to the normal positive 2’s over the next couple of years. Vaccinations are happening at incredible speed with more than 90 million American’s are fully vaccinated YTD, with doses administered per day now averaging at just under 3 million.1

This is encouraging news—now what does this all mean for the retail sector? Perhaps after a grueling year for retail, what had become an interpretive dance in business strategies is beginning to return to its familiar groove. In the BHDP retail team’s conversations with retailers, we are hearing this optimistic tone daily. But let’s not forget the shopper response. How do they anticipate their behaviors or “dance moves” will change in the next 12 months?

What Shopper Data Tells Us

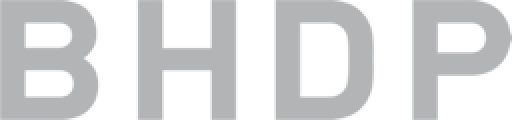

In BHDP’s latest and third round of shopper research which was conducted nationwide in late February 2021 by an independent market research firm, we see many parallels to the strong economic indicators. This most recent 1,000 response survey revealed shoppers want to return to the in-store format. They want the normal shopping lifestyle that enables them to enjoy the freedom and thrill of shopping. According to the survey, their level of desire and excitement steadily increases in the year ahead—particularly in the indoor mall format.

There is, however, a catch. Despite their desire to return to normal retail with their pent-up demand and buying power, some shoppers remain concerned about their safety within the physical store environment.

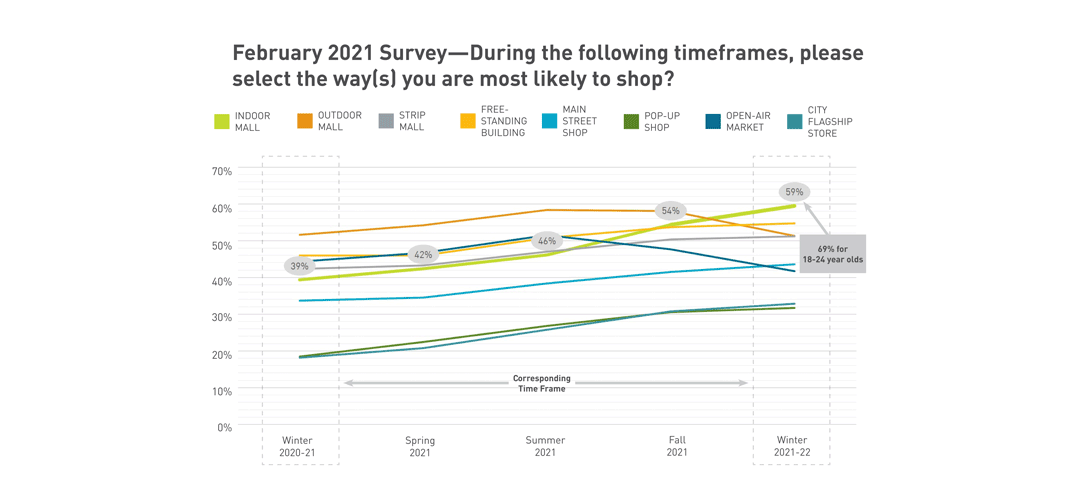

In fact, in our June 2020 survey, 38.5% of shoppers surveyed told us that they will still have concerns post-pandemic about in-store shopping. That is more than 1 in 3, and possibly indicates a lagging and even lingering level of anxiety amongst a significant number of shoppers.

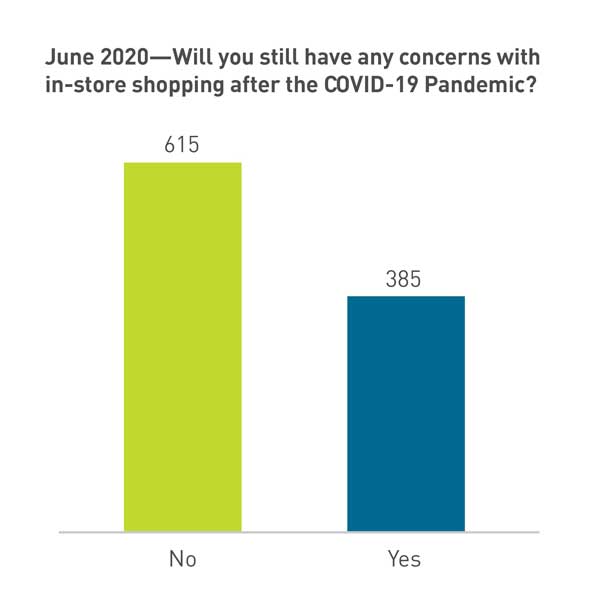

Similarly, in our February 2021 survey, shoppers expressed a desire for retailers to maintain many of the healthy and safety procedures integrated in-store in response to the pandemic.

The Second Step Forward: Bringing Shoppers Back In-Store

In Part II, we promised that our final installment of the Retail Rumba would offer solutions for relieving shopper anxiety and creating safe in-store experiences. The fix is uncomplicated. Shoppers are anxious about certain elements of the in-store experience. and they have clearly stated what specific elements concern them most. Retailers can implement these simple changes into their “dance” routine.

Make It Safe

Enhanced in-store security and safety procedures are no longer a “nice to have”—they are essential. Shoppers expect a new and heightened level of personal safety when in-store. In response to the question, “What reasons influenced your decision to not return to a store,” the response, “Lack of security/feels unsafe,” was a shopper hot button that surfaced in our February 2021 research, up 14% in comparison to our June 2020 survey. If retailers are thinking of removing distancing barriers, less restrictive face mask mandates and maximizing store capacity soon—they should think again. Shoppers have spoken clearly and loudly that they want to mask-up, they want to see plexiglass barriers at check outs, and they do not want stores to be over-crowded. It is likely that these shopper concerns will wane as vaccination rates increase; but in the meantime, we cannot ignore what shoppers are telling us. We must make every effort to make them feel safe in-store now.

Relieve Shopper Anxiety

Levels of anxiety have seen a steady rise to high levels of concern since the onset of the pandemic. This requires communication to shoppers in a voice that they understand to assure them that their in-store health and safety are the highest and absolute priority.

It is clear from their responses to the survey; shoppers want transparency and expect honest communications about heightened procedures in-store. They want to see descriptions of safety procedures readily accessible in store. In comparing our June 2020 survey to our February 2021 survey, this specific issue spiked by over 33%, making it one of their biggest concerns. Fortunately, this is a simple fix, but it cannot simply be messaged. Both messaging and procedures must be clearly obvious to in-store shoppers. To gain shopper trust, retail associates must demonstrate that heightened procedures are in effect and being practiced in front of shoppers.

Finding Our Footing

At the height of the pandemic in 2020, we followed the music as best we could, and missteps were had. Retailers could not realistically define solutions without knowing the true nature of the problem. We were still trying to find our footing amid the COVID-19 pandemic, but we are getting into our rhythm again. We need to implement these strategies now to regain the confidence of our shoppers and prove that this resilient industry is ready to deliver safe shopping environments for our loyal and valued customers.

It is time to invest in the in-store experience to make it safe. We need to turn shoppers’ anxiety into confidence. We must take the next step forward in our “Retail Rumba” and make the overall in-store experience better than before.

1https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20210317.htm

Author